"We must remain positive": Darwin property remains in a slump

Contact

"We must remain positive": Darwin property remains in a slump

Darwin's declining population is weighing on the property market, Quentin Kilian, chief executive of the REINT, told SCHWARTZWILLIAMS.

The Northern Territory property market is being weighed down by the city's declining population, REINT chief executive, Quentin Kilian told SCHWARTZWILLIAMS.

'The Northern Territory real estate local market report', which is published by the REINT, shows the Darwin property market experienced "lacklustre" conditions during the December quarter.

“While it finished with a small bounce in house sale volumes and median prices, it is a stretch to claim the market has bounced back," said Kilian.

"The underlying factor has been a substantial drop in population," he said. The wrap-up of the $45 billion Impex gas project has seen 8,500 workers leave the city, said Kilian. When those workers take other ancillary workers with them, as they often do, the impact is compounded, he said.

Kilian said unfortunately there are no new projects in the pipeline that might keep those workers in Darwin.

The closure of various defence units in and around Darwin has also been bad for the market, said Kilian, as has the oversupply of apartments that were built when the Impex project was first launched.

Kilian said the Darwin business community is calling on the government to implement policy that will bring more stable and permanent populations to Darwin.

"On the bright said," said Kilian. Affordable prices, the first-home buyer grant, and stamp duty exemptions are making the market more attractive for first-home buyers.

Click here to read The Northern Territory real estate local market report.

The data

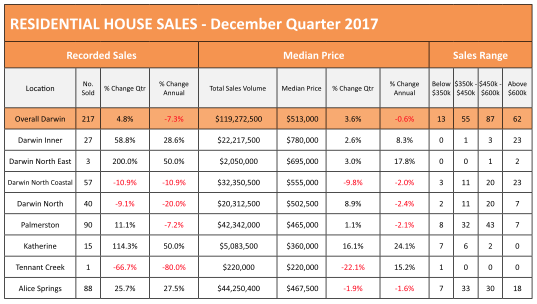

Greater Darwin saw a 4.8 per cent rise in the volume of houses sold during the December quarter, which is positive but it remains 7.3 percent behind the same time last year, and the 2016 figures were some of the worst on record, according to the report.

Source: 'The Northern Territory real estate local market report'.

Palmerston saw a healthy rise in house sales, up 11 percent from the previous quarter, but again, still 7 per cent lower than for the same period the previous year.

“The exception to this rather dreary outlook on the market, all year, has been Alice Springs which has had an exceptional year,” said Killian

Alice Springs house sales were up by 25.7 per cent, or 27.5 per cent higher than the previous year.

“Even in the unit/townhouse market, Alice Springs has seen very steady growth in sales”, said Kilian.

Despite the increase in sales, median prices are down, said Kilian.

On a more disappointing note, Greater Darwin unit / townhouse sales were down.

“This quarter in Greater Darwin recorded yet another sizable fall in volumes of sales in the unit market - down by a further 18.7 per cent which is 30 percent lower than last year’s figures," said Kilian.

Median prices are now down 22 per cent from the same period last year.

Kilian said the rental market steadied late last year. The median rent for Greater Darwin on a three-bedroom house has risen 2 per cent to $487.50 per week. However, the median rent for a two-bedroom unit has continued to slide, falling a further 1 per cent to $362.00 per week.

Palmerston had a better quarter in the rental market, with rents rising on both houses and units by an average of 1.7 percent, according to the report. Alice Springs saw some slight movements in rental prices, but is generally flat against the previous quarter.

For investors, rental yields in Greater Darwin remain strong, finishing the December quarter with a 4.9 per cent yield on houses and a 5 per cent yield on units. Alice Springs and Katherine continue to produce the best yields across the region. Alice providing 5.7 per cent yields on houses and an 8.3 per cent yield on units. Katherine had a 6.1 percent yield on houses.

Kilian said the only "black ink" on the ledger is for vacancy rates.

Darwin's vacancy rate for houses fell to 6.8 per cent but jumped a further 1.6 percent in the unit market to 7.3 per cent.

Fears a land tax could drag the market even lower

Kilian noted the REINT's concern about the NT government's proposal to introduce a land tax.

"Away from statistics, one of the biggest challenges facing us at present is the Northern Territory Revenue Discussion Paper issued for comment by the NT Government. Essentially it is proposing a raft of new taxes to be imposed on Territorians, the most abhorrent, in our view, being a Land Tax.

"If brought in, (the tax) would be levied on all property owners in addition to the Stamp Duty.

"The REINT has lodged a submission to this consultation taking the position that, at the best of times it would oppose the imposition of a further tax but to consider implementing a tax in this current economic climate that would punish home owners and new purchasers, and drive investors from the marketplace, would be quite ludicrous.”

Click here to read The Northern Territory real estate local market report.

Read more about NT real estate:

Bottom of the property market cycle is not a time for panic