RBA affordability report paints bleak picture of first homes

Contact

RBA affordability report paints bleak picture of first homes

The Reserve Bank's December Bulletin has painted a bleak picture of the homes first-time buyers can afford, particularly in Sydney.

The Reserve Bank's December Bulletin has painted a bleak picture of the homes first-time buyers can afford, particularly in Sydney.

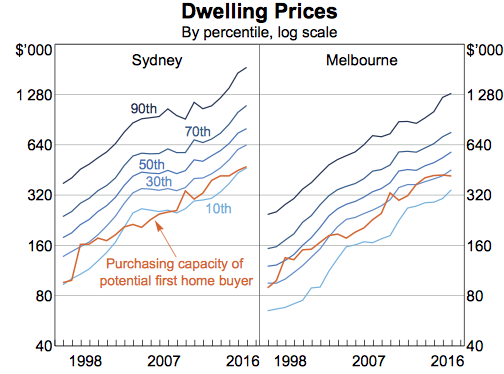

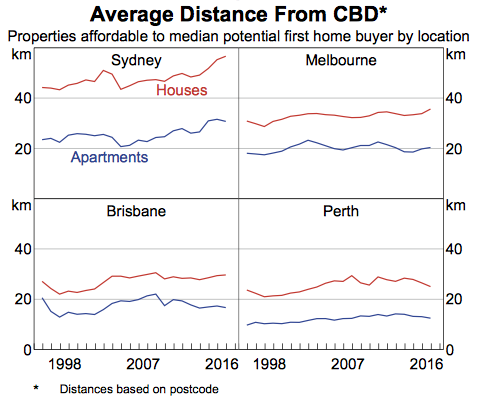

First-home buyers can afford smaller homes further from the city than they were able to afford in the past, according to the report titled 'Housing accessibility for first-home buyers'.

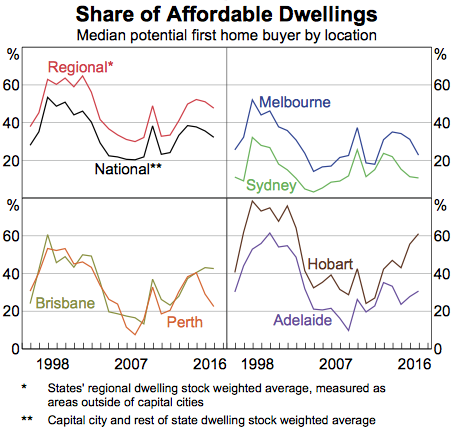

The report states the median first-home buyer can afford about one-third of the homes in Australia - 32 per cent, and about the average rate of the past 20 years. However, the situation varies enormously from place to place.

The average potential first-home buyer in Sydney could only afford 10 per cent of homes sold in 2016, according to the report.

Source: RBA.

Over the past 20 years, first-home buyers have generally been able to afford 10 to 30 per cent of the homes for sale in Sydney.

And in regional areas, the median first-home buyer could afford almost half the housing stock for sale.

Source: RBA.

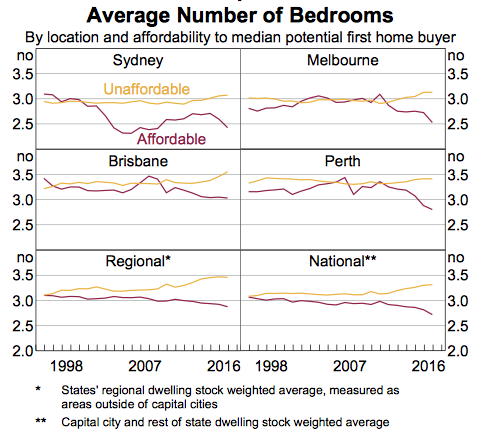

The quality of first homes has deteriorated across the board, the report claims, but has worsened to the greatest degree in Sydney.

Of the homes considered to be within reach of first-home buyers, the report says "there has been some structural decline in the quality of housing that is affordable to first-home buyers."

The average number of bedrooms in accessible homes has fallen in all capital cities over the past 20 years, and the most sharply in Sydney.

Source: RBA.

First-time buyers could also only afford to live further from the city. The average distance between affordable homes in Sydney and the CBD had risen steadily over the past 10 years.

Source: RBA.

The report also finds that the number of households renting has trended up is recent decades, and rent-to-income ratios for lower-income households have risen in the last 10 years.

Read the RBA's December Bulletin 'Housing accessibility for first-home buyers'.

Read more about the RBA:

Rates set to remain at historic lows into 2018

Interest rates on hold: what does it mean for the property market?