Australians are holding onto their homes for longer

Contact

Australians are holding onto their homes for longer

The transaction costs of buying and selling a home have become prohibitive, but cuts to stamp duty and low-cost agents could make buying and selling more affordable, says Cameron Kusher of CoreLogic.

Australians are holding onto their homes for longer, tying up much-needed housing stock, and adding to the upward pressure on already booming property prices, says Cameron Kusher, head of research, CoreLogic.

Kusher told SCHWARTZWILLIAMS that the average hold period for Melbourne houses is 11.9 years, just ahead of Sydney's hold period of 11.7 years, and Brisbane’s 10.9 years. Holding periods have been trending higher, he said.

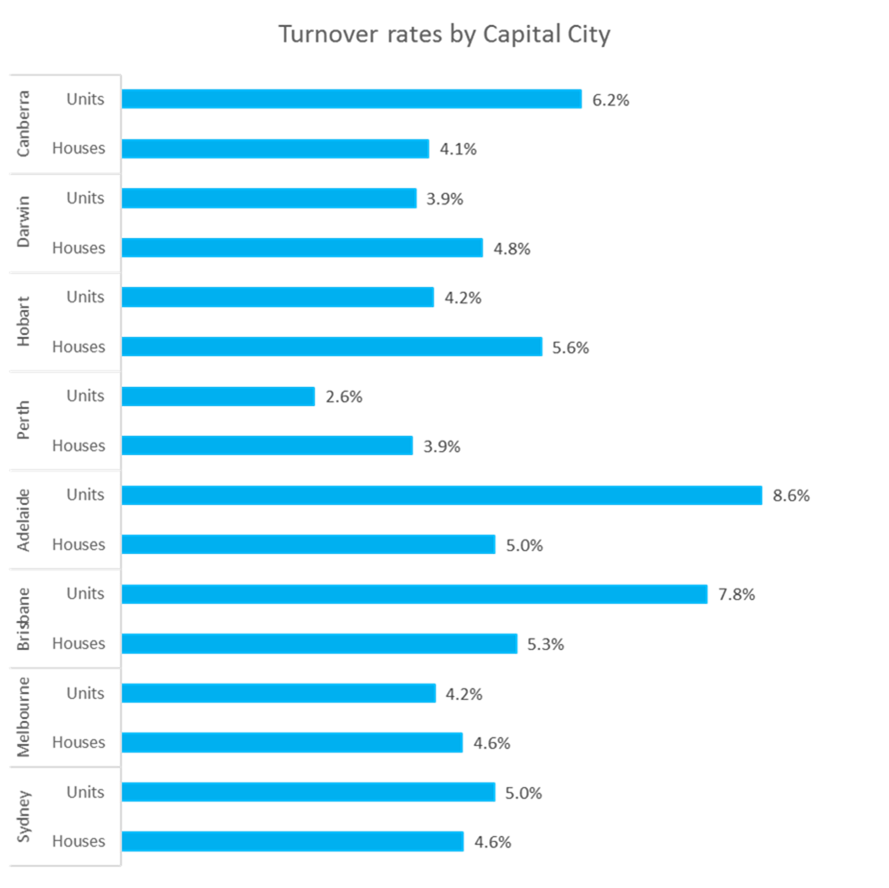

Turnover rates are also historically low, said Kusher.

"What we're seeing in Sydney is a real lack of supply leading to increased price pressure," he said.

Kusher said that owners are holding onto their homes partly because they want to stay in familiar surroundings, but also because the cost of stamp duty when they buy and agent fees when they sell are so high.

However, Kusher said Sydney listings are up 16 per cent on last year, which could be a positive sign. Melbourne listings are steady, he said.

Source: CoreLogic.

Australians are also living longer, meaning they are staying in their homes for longer. Australia has the third-highest life expectancy in the world behind Japan and Switzerland. Over the last five years, the life expectancy of the average Australian has risen from 81.9 years to 82.4 years.

Kusher said releasing supply onto the market from existing housing stock is an important factor in containing price growth. Most of the new housing stock being built is targeted at investors and first-home buyers, he said.

What's the solution?

Kusher said one solution to encourage the release of more housing stock onto the market is to lower the costs of transactions.

"Ideally you would remove some of the stamp duty," he said. The recent return of first-home buyers to the market in New South Wales and Victoria shows that stamp duty concessions do increase the number of transactions, he said, referring to the recent cuts for first-home buyers in those states.

Related content: Affordability is improving, and first-home buyers are back in the market

But Kusher conceded that the conversation around further cuts to stamp duty would be "difficult" while strong property markets are generating huge income streams for state governments.

Kusher said the emergence of low-cost agents will also lower property transaction costs.

Read more about housing affordability:

Affordability is improving, and first-home buyers are back in the market

First-home buyers at highest levels since 2013: REIA

Weekend auctions litmus test of new first-home-buyer benefits