Mortgage stress climbing, affluent borrowers most at risk

Contact

Mortgage stress climbing, affluent borrowers most at risk

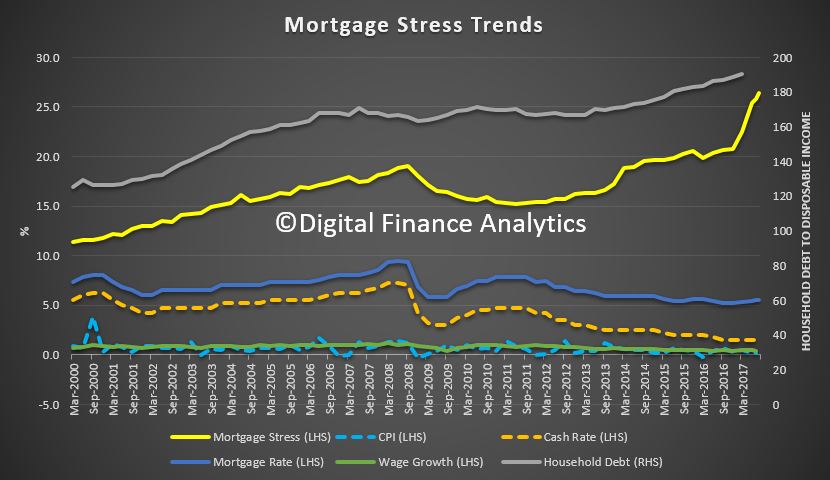

More than one quarter of Australian households are experiencing mortgage stress, according to new research by Digital Finance Analytics.

More than 860,000 or 26.4 per cent of Australian households were experiencing mortgage stress at the end of August 2017, according to new research by Digital Finance Analytics.

More than 20,000 of those household were in severe stress, according to the research.

The figure for the previous month was 820,000, or the equivalent of 25.8 per cent of households.

The number of households experiencing mortgage stress, which is defined by lower income than outgoings, is "economically significant", says Martin North, Principal of Digital Finance Analytics.

"The main drivers of stress are rising mortgage rates and living costs, whilst real incomes continue to fall and underemployment is on the rise," he said.

“We continue to see the spread of mortgage stress in areas away from the traditional mortgage belts. A rising number of more affluent households are also being impacted.”

Mosman, on Sydney's affluent the lower north shore, has 1,176 households in mortgage stress, and 129 households at risk of default in the next year, according to the research.

"Those with larger mortgages will be more impacted by rate rises if and when they occur," cautioned North.

A household budgets is the key to avoiding financial stress

North said that when households find themselves under financial stress they tend to cut back on spending, use credit cards, or refinance their loans, he said. However North advised that the most prudent option is to create a "robust" household budget.

Suburbs worst affect by mortgage stress

The top postcode for mortgage stress is Perth's 6065, which includes Wanneroo, Wangara, Landsdale, Darch, Madeley, Pearsall, Hocking, Sinagra, Ashby, and Tapping.

The postcode with the second highest rate of mortgage stress is Sydney's 2170, which includes Chipping Norton, Moorebank, Lurnea, Mount Pritchard, Liverpool, Casula, Prestons, Warwick Farm, and Hammondville.

The Melbourne postcode with the highest rates of mortgage stress is 3806, which encompasses Berwick and Harkaway.

Source: Digital Finance Analytics.

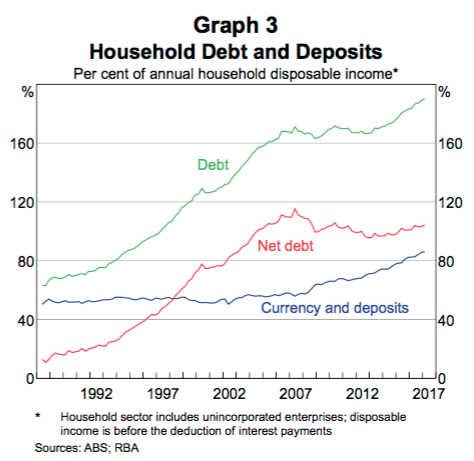

The RBA has said it is concerned about household debt

The Reserve Bank of Australia has warned that property buyers stretching to enter the property market could be "vulnerable" to economic shocks, such as an increase in interest rates or a change in personal circumstances, such as the loss of a job, or divorce.

RBA research shows that debt for the nation's top 20 per cent of households is at least 190 per cent of income, an increase of more than 50 per cent in the 12 years to 2014, the latest Reserve Bank of Australia numbers.

Interest rates "lower for longer" could provide some relief for those in mortgage stress

On the bright side, Digital Finance Analytics is predicting lower rates of mortgage default, primarily because it now expects interest rates to be "lower for longer".

Read more about household debt:

Lenders offering lower interest rates, incentives in lead up to spring

Borrowers well placed to withstand modest rises in interest rates

Low inflation data suggests interest rates likely to remain low: REIA