Melbourne family homes have the fastest growing prices in the country

Contact

Melbourne family homes have the fastest growing prices in the country

New data from the REIV shows three and four-bedroom homes in middle-ring suburbs are the fastest growing property type in Melbourne, which itself is the fastest growing market in the country.

SCHWARTZWILLIAMS takes a look at the latest data, and what it tells us about property prices around the country.

REIV data shows Melbourne family homes are the best-performing property type

Large homes in Melbourne’s middle-ring suburbs were the best-performing property type in Victoria in June, according to data from the Real Estate Institute of Victoria.

The price of four-bedroom homes in Melbourne’s middle-ring suburbs rose 6.5 per cent to a median of $1,150,000 in June, outpacing all other Victorian property types and regions.

Source: REIV.

REIV President Joseph Walton said growth for large homes within 20km of the CBD is being driven by demand from both owner-occupiers and developers, and reflects strong population growth.

“Larger homes remain attractive to a broad range of buyers, particularly in the city’s middle ring where densification and height restrictions have been lifted,” he said.

With the median price of a four-bedroom house within 10km of the CBD sitting at just under $2 million, according to REIV data, middle-ring sellers are benefiting from buyers being priced out of inner city suburbs.

“Family homes in Melbourne’s inner ring are out of reach for many buyers," he said.

Three-bedroom homes recorded the largest price growth, rising 4.8 per cent to a median of $697,250.

Source: REIV.

Melbourne is outperforming all capital cities: CoreLogic

The strong growth in prices for Melbourne family homes is reflected in the latest CoreLogic figures, which show Melbourne prices outperformed all other cities in July, rising 3.1 per cent for the month. CoreLogic's Hedonic Home Value Index showed Sydney prices only rose 1.4 per cent in July, and Canberra prices were up 2.4 per cent.

Brisbane, Perth, and Darwin prices declined, according to the CoreLogic index.

Source: CoreLogic.

Tim Lawless, head of research CoreLogic, said Sydney and Melbourne prices might be showing a partial recovery from the "seasonal slump" in values recorded in April and May, and may be benefiting from new stamp duty concessions for first home buyers in New South Wales and Victoria.

“Melbourne appears to be benefiting from consistently high population growth which is creating strong demand for housing, as well as consistently high jobs growth and more affordable housing options relative to Sydney," he said.

The CoreLogic numbers show the quarterly pace of price growth has slowed, with the combined capital cities index rising 2.2 per cent for the three months to the end of July, down from 3.6 per cent for the three months to the end of February.

There is likely to be a rebalancing towards Brisbane: Alex Jordan, McGrath

Though CoreLogic data shows Brisbane prices eased 0.6 per cent for the month of July, and were down 0.7 per cent for the quarter, Alex Jordan, agent with McGrath Paddington, sold a five-bedroom home at 57 Castile Street, Indooroopilly, for $3.2 million last week.

Jordan told SCHWARTZWILLIAMS he was seeing a bit uptick in enquiries and inspection numbers since July. The Castile Street property had been on the market for a number of months, but with more buyers entering the market, houses are now beginning to move.

Source: CoreLogic.

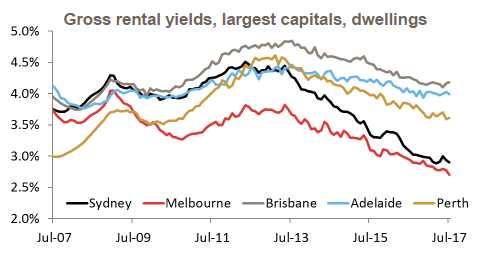

Jordan said he expects to see some rebalancing in the market between Sydney and Brisbane. With Sydney yields sitting at 2.7 per cent for houses and 3.7 per cent for units, and Brisbane yield sitting at 4.1 per cent for houses and 5.3 per cent for units, according to the latest CoreLogic numbers, Jordan said investors are beginning to shift their interest towards Brisbane.

Jordan said the potential for capital growth was also higher in Brisbane than in Sydney.

Source: CoreLogic.

Capital city prices have risen 52.8 per cent during the current growth cycle

Sydney prices have risen 64.6 per cent during the current growth cycle, and 113.7 per cent since January 2009, during the lows of the GFC.

Melbourne prices have risen 64.6 per cent during the current cycle, or 101.4 per cent since the GFC.

Source: CoreLogic.

Read more about real estate prices:

Why is Melbourne's property market outpacing Sydney's?