'Super City' Sydney seventh on Knight Frank foreign investment list

Contact

'Super City' Sydney seventh on Knight Frank foreign investment list

Knight Frank's inaugural report, Active Capital – The Report 2017, which looks at foreign commercial real estate investment in ten 'Super Cities', lists Sydney in seventh place.

Sydney sits in seventh place in Knight Frank's inaugural Active Capital – The Report 2017, which looks at foreign real estate investment in ten 'Super Cities'.

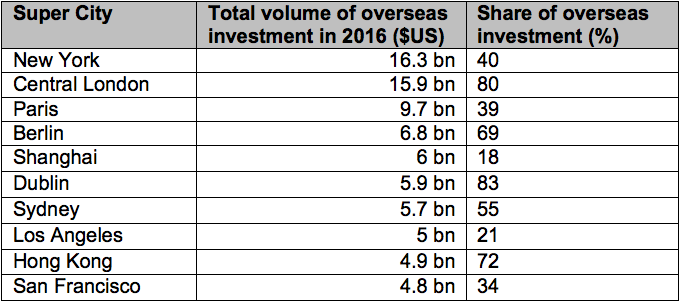

The harbour city attracted the seventh largest volume of commercial property investment of the '10 Super Cities' monitored by Knight Frank, with US$5.7 billion (or just over AU$7 billion) worth of offshore investment in 2016.

Of total investment in Sydney’s commercial property sector, 55 per cent came from offshore buyers last year.

Source: Knight Frank.

New York, London, Paris, Berlin, Shanghai, and Dublin came in ahead of Sydney.

New York attracted the most overseas capital in 2016, with $16.3 billion invested from offshore, but remained largely driven by domestic buyers, who accounted for 60 per cent of total investment.

London is the 'Super City' most driven by overseas capital, with $15.9 billion invested from offshore, representing 80 per cent of total volumes.

Source: Knight Frank.

According Jennelle Wilson, Senior Director, Research, Australia at Knight Frank, said investors are increasingly looking for yield in the current low-return environment. Wilson said Sydney is likely to continue to attract offshore funds.

“Investors are looking for security of income, liquidity and diversification," she said, noting that all are "equally important".

"An increasingly open outlook from a number of governments, such as China and Taiwan, who have loosened restrictions on overseas investment," is also helping the global flow of capital into foreign real estate markets.

Melbourne and Brisbane have also been targets for offshore investment, said Wilson.

“Sydney has definitely been the focus of offshore investment, accounting for 45% of inflows for 2016 and 2017, followed by Melbourne (32%) and Brisbane (10%)," she said.

Paul Roberts, Joint Head of Institutional Sales, Knight Frank, Australia said, “The investment case for Sydney CBD Prime assets has never been stronger. Record levels of rental growth, significant public infrastructure improvements and low levels of net supply over the next three years will see continued demand from offshore investors," he said.

Knight Frank’s Ben Schubert, Joint Head of Institutional Sales, Australia said, “From a global perspective, Sydney is punching well above its weight in terms of demand from offshore capital, which coupled with meaningful local demand is driving significant yield compression.

Anthony Duggan, Head of Capital Markets Research at Knight Frank, added: “The globalisation of real estate will continue apace in 2018, and we predict more than 30% of total global transactions will be cross-border."

Download the Knight Frank report here.

Read more about global investment flows into Australian real estate:

Capital gains withholding tax too low for foreign residents says REIA