Experience matters: HoldenCAPITAL

Contact

Experience matters: HoldenCAPITAL

An experienced development finance broker, like Melvin Seeto of HoldenCAPITAL, can attract competitive pricing and terms from lenders.

Much has been reported in recent times about the tighter borrowing conditions in Australia resulting from increased regulatory intervention in the lending practises of banks since September 2015. Across the board, borrowers of all shapes and sizes have been adversely impacted, from those seeking loans for the purposes of buying a home, a residential investment, a commercial investment property or funding for construction finance.

The major banks are imposing lower gearing levels and higher hurdles such as minimum thresholds for interest cover ratios from leases or other income and borrowers find themselves dealing with alternative funding sources and the resultant higher increased interest rates and fees. While important, the experience of the borrower is not always critical in the overall approval process. The exception is when looking at construction loans, where it’s often a key determinant of the interest rate and terms a borrower faces when securing that elusive letter of offer.

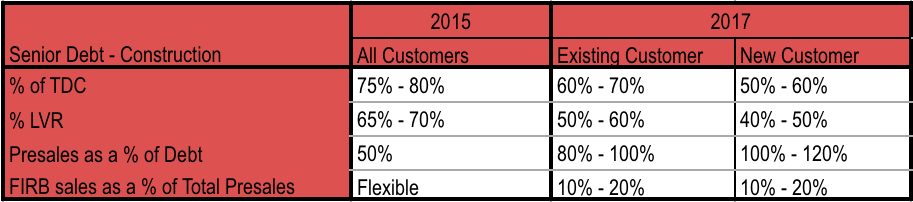

Developers who have active projects will attest to the evolving funding landscape, with most suffering from 'deal shock' at the increasingly onerous funding environment and only a select few still experiencing business as usual with their traditional bank. For those who have not been active or sought project funding over the past 12 months there is a reality check in store as reflected in the following table for bank funding.

Source: HoldenCAPITAL.

Obviously, other factors come into play but for most this reflects the reality of the market and as explained in previous commentaries, reflects a regulatory driven and permanent structural shift, not a temporary market adjustment.

Key criteria impacting a development loan approval include:

- Location and demographic factors

- Qualifying presales volumes or leasing pre-commitment

- Strength of builder

- Demand and supply for the product type

- Strength of developer balance sheet

- Developer experience

These last two factors are what we are seeing have the greatest influence on securing bank funding and the resultant facility terms.

For those banks still taking development applications, most now classify who qualifies as 'existing' or 'new to bank' with several requiring the previous four projects to have been funded by the bank to be considered at all.

Being classified as 'new to bank' results in lower loan to cost ratios ranging from 50 per cent - 60 per cent of total development cost and/or an 'on completion' LVR of 40 per cent -50 per cent. If you’re an 'existing customer' you may see 60 per cent -70 per cent and 50 per cent -60 per cent respectively, but it’s a far cry from the 75 per cent - 80 per cent of TDC and 65 per cent - 70 per cent LVR available to most only 18 months ago.

The reality is that developers with strong balance sheets are more likely to satisfy the banks' increased requirement for greater equity, so the question turns to what are the alternatives?

There are options to fill the 'equity' gap with the usual suspects comprising subordinated debt, equity options such as mezzanine debt, preferred equity or even finding a joint venture partner, however they all come with their own challenges.

The coordination of subordinated debt or equity structures can be complicated and I will leave that for another day and focus on the growing sources of alternative finance which are not readily visible to many developers. The rise of these 'non banks' such as mortgage funds, private lenders, family offices, crowd funders and offshore funding sources are characterised by small teams managing investment funds ranging from $10 million - $500+ million although, for the most part, they tend towards the lower end of the scale.

Without the distribution capabilities of a bank, these smaller funds need to attract investors which in turn is driven by their ability to secure sound deals delivering attractive returns that repay on time. With new “Funders” opening for business every week (our own list currently stands at 150+), the competition is fierce and these groups largely rely on intermediaries/brokers to source loan opportunities. This effectively outsources the deal structuring, preliminary due diligence and preparation of credit proposals reducing overheads and streamlining the internal credit/approval process.

These lenders also don’t have the repository of data surrounding deals and borrower history of the larger banks and lenders and tend to default to lending based on the quality of the deal and the experience of the borrower. More and more, in our position as the largest dedicated development finance broker in the country we see that experience does matter in providing developers with the ability to attract competitive pricing and terms from lenders.

For less experienced developers, it is about sourcing and providing a funding solution to complete their project in an environment where the historical sources of finance are no longer a viable option.

The challenge for all developers is knowing how to navigate the myriad of marketing 'noise' in order to find the lender with the appetite to support their project. To achieve this is efficiently, an experienced construction finance broker is therefore equally important in today’s complex development finance environment.

This article was written by Melvin Seeto, State Manager NSW, Holden Capital, a bespoke construction finance firm.

HoldenCAPITAL arranges construction finance and invests in projects through their equity trust, HoldenINVEST.

To discuss your project finance requirements please call (07) 3171 4200 or visit www.holdencapital.com.au.

This is a sponsored article.

Read more from HoldenCAPITAL:

Navigating the ever-changing oceans of development finance

State of play in construction finance: HoldenCAPITAL