Capital gains withholding tax too low for foreign residents says REIA

Contact

Capital gains withholding tax too low for foreign residents says REIA

The threshold for foreign-resident capital gains tax withholding has been reduced to an unnecessarily low level, subjecting agents and conveyancers to additional red tape and costs for no good reason, says Malcolm Gunning of the REIA.

The threshold for foreign resident capital gains tax withholding has been reduced to an unnecessarily low level, subjecting agents and conveyancers to additional red tape and costs for no good reason, says the Real Estate Institute of Australia.

The initiative in the 2017 Budget that lowers the threshold for foreign-resident capital gains tax withholding to $750,000 from the current $2 million. The change is expected to become effective from 1 July 2017.

The proposed threshold of $750,000 is unjustifiable, says REIA president Malcolm Gunning.

“If the threshold was to be reduced it should be to no less than $1.5 million,” Gunning said.

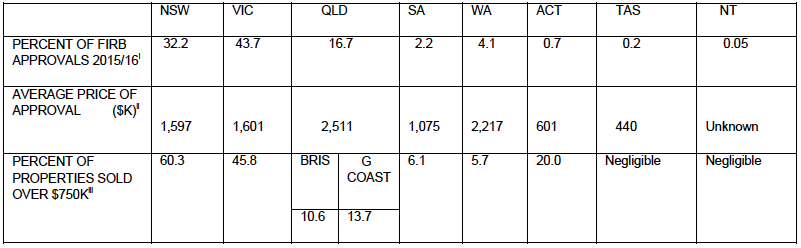

“Based on data in the latest Foreign Investment Board Annual Report, 76 per cent of foreign purchasers bought in NSW and Victoria and the average purchase price was $1.6 million.

“Queensland accounted for a further 17 per cent of properties at an average price of $2.5 million. The remainder of the states and territories account for 7 per cent of properties purchased by foreign owners and the average price across Australia was $1.8 million.

“The proposed $750,000 threshold means that half the properties sold in Melbourne and Sydney will be subject to the withholding provisions, yet foreign investors are buying properties at double this value,” Gunning said.

Source: REIA.

Gunning added an additional concern for REIA is the limited scope for an education campaign ahead of the 1 July 2017 rollout.

“When the withholding tax was first introduced it applied to far less property and involved far fewer markets, yet far more time was available for the REIA to work with the ATO in educating agents,” Gunning said.

“This isn’t simply a case of letting agents know of a new threshold. There are a whole new set of agents in additional markets involved. A delay by six months would be more appropriate and introducing it part way through a financial year should be acceptable as the withholding tax was first introduced in the middle of a financial year.

“We have contacted Federal Treasurer Scott Morrison regarding our opposition and have asked that the government reconsider the threshold,” Gunning said.

Read more about the restrictions on foreign buyers of Australian real estate:

Housing measures in the 2017 Budget

NSW moves a "great first step" to improve affordability: REINSW