How did Donald Trump’s election victory affect buying Asian property?

Contact

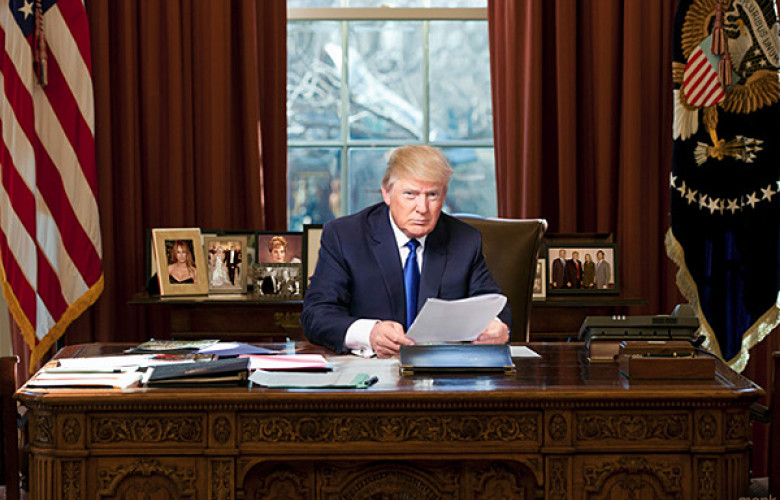

How did Donald Trump’s election victory affect buying Asian property?

The election of US President Donald Trump has created uncertainty in financial markets, affecting currency markets in our region, and influencing cross-border property transactions.

Though it happened thousands of miles away, the US Presidential Election had a significant impact on those looking to buy property in Asia at the end of 2016.

Donald Trump’s victory shocked the markets. In turn, the market reaction shocked economists. Many had predicted a huge slump in the value of the US Dollar if Trump emerged victorious, but after an initial sell-off, the ‘Greenback’ quickly began to race higher.

This pushed the Australian Dollar lower, because when there is a good chance the stable USD will appreciate, investors have little need to gamble on the more risky AUD to make a profit.

US Dollar strength came down to Trump’s campaign promises. He claimed he would increase government spending by US$1 trillion in an attempt to boost the economy. This would have several effects that investors would approve of, including faster economic growth, lower unemployment rates, higher inflation and increased chances of America’s central bank, the Federal Reserve, raising interest rates.

Anticipation of all this happening saw the US Dollar rising sharply in the weeks following the election. By the end of December, the USD/AUD exchange rate had climbed around 7% to an eleven-month high of 1.3958.

For those looking to purchase a property in Asia - which is usually priced in US Dollars - this meant every US$100,000 cost them AU$139,586; an extra AU$10,554 compared to just before the election.

What can you do about AUD depreciation?

Quite a lot, actually. Most currency exchanges are conducted as ‘spot transfers’, which means the transfer is made instantly at the going market rate. But there are tools available that allow you to wait for better rates, prevent your transfer being made below a certain rate, or even hold onto a strong rate for future use.

The latter is called a forward contract. You agree to buy a certain amount of currency on a certain day or time period in the future - up to two years in advance - using the exchange rate at the time you set up the contract. It’s an obligation to buy, so you must make the trade during the set timeframe.

Should the market drastically weaken, your transfer will still be conducted at the better rate you fixed. This could save you tens of thousands on large transfers.

It’s important to know about tools like forwards if you are considering purchasing a property in Asia, because the risk of currency volatility hasn’t subsided just because the US election is over.

If Trump does take steps to boost the economy, or the Federal Reserve does indicate it will continue raising interest rates, this would push the US Dollar higher, making Asian properties even more expensive for aspiring expats.

Protecting yourself against these adverse market movements needn’t be complicated. Using tools like forward contracts, you can ensure you still get a favourable exchange rate, can plan your property purchase in greater detail and relax knowing that the forex part of the buying process will be hassle-free.

Click here to receive a free currency quote form TorFX.

A version of this article appeared on RETalk Asia.

The is a sponsored article.

Read more about TorFX:

How to manage your currency exposure when buying property overseas