Sydney, Melbourne sellers rush to list properties as prices soar

Contact

Sydney, Melbourne sellers rush to list properties as prices soar

Sellers in Sydney and Melbourne rushed to put their properties on the market in March - before ripe conditions turn sour.

In the booming Sydney and Melbourne property markets, the number of properties listed for sale in March jumped significantly, suggesting sellers are rushing to take advantage of ripe market conditions - before they turn sour.

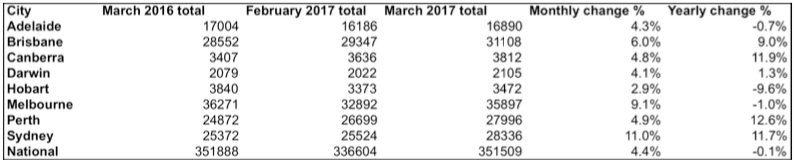

According to the latest data from SQM Research, the number of Sydney property listings rocketed 11.0 per cent higher in March, and in Melbourne listings soared 9.1 per cent.

Every capital city recorded a rise in listing numbers, though not as strong as those recorded in Sydney and Melbourne.

Source: SQM Research.

Louis Christopher, managing director of SQM Research, said the big rise in listings in Sydney and Melbourne suggests many property owners are attempting to cash in on rapid growth in prices.

Christopher says the Australian Prudential Regulation Authority's measures to restrict interest-only mortgage lending are not strong enough to offset the strong demand created by low interest rates and strong population growth.

The measures "are weak and are not going to be enough to slow down the Sydney and Melbourne housing booms, where both owner occupiers and investors are feeding demand,” he said.

SQM Research data for house asking prices, which is a forward looking indicator of house prices, shows that for the three months to 4 April asking house prices continued to grow steadily.

Growth in asking house prices:

- Melbourne +7.2 per cent

- Canberra +6.8 per cent

- Hobart +6.4 per cent

- Sydney +4.5 per cent

- Adelaide +2.0 per cent

- Brisbane +1.1 per cent

- Darwin -2.4 per cent

- Perth -2.2 per cent

See also:

The Perth suburbs selling more quickly now than in 'boom' times

Brisbane apartment market returning to average after boom: Place Advisory