RBA uses strongest language yet to warn of housing 'risks'

Contact

RBA uses strongest language yet to warn of housing 'risks'

As ABS data confirms that property prices are rising strongly in some cities, the minutes of the March Reserve Bank board meeting flags concerns about the "build-up of risks" in the housing market.

The Australian Bureau of Statistics confirmed yesterday that property prices are rising strongly in the nation's largest property markets of Sydney and Melbourne. The data came as the minutes of the March Reserve Bank board meeting flagged concerns about the "build-up of risks" in the housing market.

The ABS data shows that Australian home prices rose by 4.1 per cent in the December quarter to stand 7.7 per cent higher over the year.

The data also showed slower growth in the number of homes over the past 12 months. Surprisingly, the number of homes in Australia grew by 172,800 in the year to December after recording gains of 185,800 in the year to September, and 182,400 in the year to June. It was the smallest annual increase in the number of homes in 15 months, according to Craig James, chief economist of CommSec.

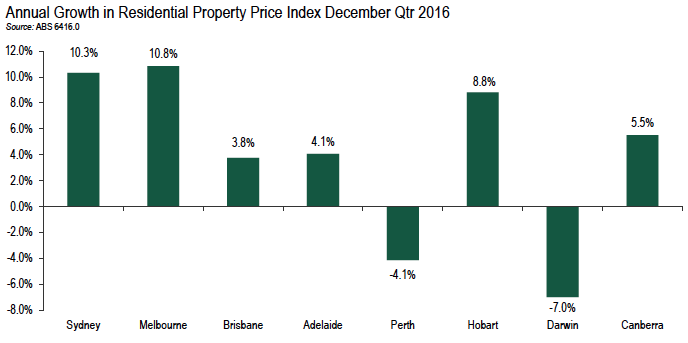

As expected, the property price numbers varied from city to city.

In Melbourne prices rose 5.3 per cent for the December quarter, in Sydney they rose 5.2 per cent. In Brisbane prices were up 2.2 per cent for the quarter, in Adelaide prices were up 1.8 per cent, in Canberra prices rose 2.8 per cent, Perth prices rose 0.3 per cent, and Hobart property prices jumped 4.5 per cent for the quarter. Darwin was the only city to record a decline for the quarter, prices eased -1.5 per cent.

For the year, Melbourne prices surged 10.8 per cent, Sydney prices jumped 10.3 per cent, Brisbane prices were up 3.8 per cent, Adelaide prices rose 4.1 per cent, Canberra saw a rise of 5.5 per cent, and Hobart property prices were up 8.8 per cent. Perth property prices are down 4.1 per cent for the year and Darwin prices are down 7.0 per cent.

“This result for the December 2016 quarter shouldn’t surprise anybody," sais Dr Harley Dale, chief economist with the HIA. "Nor should the large divergence in growth rates between Australia’s eight capital cities.”

Source: ABS, HIA.

James says the minutes of March Reserve Bank board meeting show "there is clearly a number of ‘hot button’ issues that occupy policy maker thoughts", and that "central bank officials are ramping up their discussions and commentary on the housing sector."

James says the minutes contain "the strongest language yet" about the housing market.

James notes the minutes' mention of the “build-up of risks associated with the housing market”, including “briskly” rising home prices, “a considerable” lift in additional supply of apartments scheduled to come on stream over the next few years, slowing growth in rents, rising investor finance, and the most concerning of all according to James, the growth in household debt outstripping incomes.

Dale urged caution to policy makers on the number. “Yes, there is some need to tighten lending conditions for some Australian housing markets in terms of geographical areas and dwelling types,” he said.

“However, a blanket tightening of lending conditions – as now seems to be emerging again – is the wrong policy and risks damaging Australia’s financial stability," he warned.

Read the minutes of the March meeting of the board of The Reserve Bank of Australia here.

See also:

Property prices at cyclical high: CoreLogic