Contact

US bomb shelters sell out, reports LA Times

There has been a run on sales of bomb shelters in the US, in the wake of President Trump's "fire and fury" comments targeted at North Korea.

Featured Property

The elegant Victorian: 'Clifton Villa', a double-frontage terrace in Clifton Hill

Victorian elegance meets cutting-edge style at 'Clifton Villa', a double-fronted Melbourne terrace. For sale through James Pilliner and Stewart Kyle of Nelson Alexander Fitzroy.

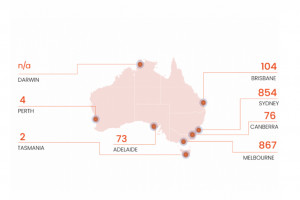

Where are Australia's most popular places for first-home buyers?

Though Queensland has the highest percentage of first-home buyers overall, Melbourne's 3029, which includes suburbs Truganina and Hoppers Crossing, is the most popular post code.

Melbourne - is it really the world's most liveable city?

Melbourne is a highly liveable city, but that doesn't mean it's without its problems.

Di Jones expands into Inner West

Di Jones Real Estate is expanding its presence into Sydney's Inner West with the hiring of two new agents, Charles Milburn and Chris Williams.

Featured Property

New York pizazz in Bardon, Brisbane

Elitha Bouwer, owner of Visionarie Homes, managed this Bardon renovation, creating the ambience of a five-star hotel, says Sacha Hennessey agent with Place West.

These missed deductions add up

BMT has created a list of assets that property investors commonly overlook when claiming depreciation, including garden sheds, exhaust fans, garden watering systems, garbage bins, intercom systems, door closers, and shower curtains.

Melbourne the 'World's Most Liveable City' for seven years, while Sydney remains outside the top ten

The Economist has rated Melbourne as the world's most liveable city for an incredible seventh year in a row - while Sydney remains in 11th position.

Australasia’s best auctioneers to compete at 2017 Australasian Auctioneering Championships

All finalist names have been revealed for the 2017 Australasian Auctioneering Championships which will be held in Adelaide this year, hosted by the REISA.

Featured Property

Darwin waterfront home by award-winning architect with Spanish themes and a 30m lap pool

Designed by well-known architect Hully Liveris, this is one of the most stunning home in Darwin. For sale through David Oliver of Elders Real Estate Darwin.

Pages

New South Wales (NSW)

Australian Capital Territory (ACT)

Profiles