Contact

Get to know Gail Miller, former Olympian, now McGrath New Farm agent

Gail Miller has joined Sherrie Storor at McGrath New Farm, and says the lessons she learned as an Olympic athlete are integral to her success in real estate.

LJ Hooker targets one of Australia's most lucrative markets

LJ Hooker is considering opening up to five new offices on Sydney's lower north shore in the coming months, as it seeks to revitalise its foothold in one of the nation's most lucrative markets.

Featured Property

Territorian home with nooks for yoga in tropical garden

An award winning, peaceful, and creative sanctuary, the apex of Territorian tropical design, provides an environment of beauty and relaxation. For sale by Paul Heron of Belle Property Darwin.

Brisbane to be major city within decade: Bernard Salt

Demographer Bernard Salt says Brisbane will hit the "major metropolitan league with Sydney and Melbourne" within a decade.

Vote for your favourite Million Dollar Intern

The 16 finalists of LJ Hooker's Million Dollar Intern competition are online, and voting is open to the public. The winner gets to work alongside LJ Hooker Double Bay's Bill Malouf for three months.

GoldenEye Media joins forces with LuxuryRealEstate.com

Local producer of high-end real estate videos, GoldenEye Media, has established its presence on the global stage, announcing a partnership with leading US agency, LuxuryRealEstate.com.

Featured Property

Ski in-ski out Mount Buller winter retreat 'Il Posto' for sale

These four Mount Buller ski chalets, with views over Bull Run valley, are designed by leading alpine architects, Salter Architects and is for sale by Mark Woodsford and Michael David of RT Edgar Portsea.

Is the market really slowing down?

There is still strong demand for property in the eastern states, says Louis Christopher, managing director of SQM Research. Sellers were simply staying out of the market in April, waiting for the holidays to end, he says.

CEO of Property Council hoses down vacant property tax speculation

Ken Morrison, Chief Executive of the Property Council of Australia, condemns as 'myth' the findings by Prosper Australia that 4.8% of Melbourne's homes lie vacant.

Taking opulence to new heights in Dubai with US$1million bathtubs

A new ultra-expensive development in Dubai features bathtubs hewn from a single piece of Brazilian quartz.

Pages

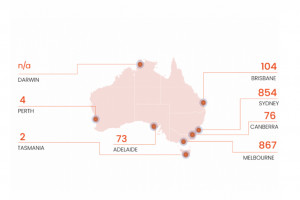

New South Wales (NSW)

Australian Capital Territory (ACT)

Profiles

Victoria (Vic.)

Tasmania (Tas.)

Western Australia (WA)

South Australia (SA)

Northern Territory (NT)

Queensland (Qld)

National

News