Low rates drive property prices ever higher

Contact

Low rates drive property prices ever higher

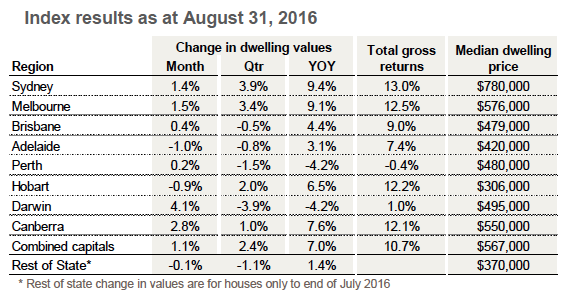

Property prices are rising around most of the country, but capital growth in Sydney and Melbourne is clearly the strongest.

Property prices rose 1.1% in August, with six of the eight capital cities recording rises, according to the CoreLogic Home Value Index.

But the broad overall gain masks divergent moves between regions and property type.

Sydney dwelling prices rose 1.4% for the month, making 9.4% for the year. Sydney prices have risen an eye-watering 64% during the current growth cycle, which began in June 2012.

Melbourne prices were up 1.5% for the month, making 12.5% for the month. Melbourne property prices have appreciated 44% over the cycle.

By contrast, prices were down around 1% for the month in both Adelaide and Hobart. For the year to August, prices in Hobart and Darwin fell 4.2%, reflecting lower migration into the cities, and higher population flows out, as well as weaker economic conditions.

Source: CoreLogic.

Though overall gains are continuing, the pace of growth is slowing, according to Tim Lawless, CoreLogic's head of research.

“Despite a strong month-on-month reading, the pace of annual capital gains has trended lower compared with the 2015 peak in growth conditions, when capital city dwelling values were rising at 11.1% per annum. The most recent twelve month period has seen dwelling values rise by a lower 7% per annum.

"However, the rate of annual growth in Sydney has virtually halved from a recent 18.4% peak to the current annual rate of 9.4%. Similarly, in Melbourne the annual growth trend peaked at 14.2% per annum last year and has since tracked back to 9.2% per annum over the most recent twelve month period,” he said.

Houses performed more strongly than apartments, with house prices in the eight capital cities rising 7.2% for the 12 months to August, and unit prices rising only 5.5%.

“The trend for house value growth outperforming unit values is apparent across most of the capital cities, particularly in Melbourne and Brisbane, where concerns around inner city unit oversupply are mounting," said Lawless.

Lawless warned that strong growth rates might not continue, particularly for apartments.

“With so much new supply being delivered to the market in the form of units, we are already seeing significantly slower growth rates for units compared to houses in a number of cities. As these unit projects come to completion and ultimately settlement, the underperformance of new unit stock could create headwinds for the market in certain geographies,” he said.

Affordability measures showed housing remains increasingly unaffordable for Australians. In the June quarter, the household income to dwelling price ratio was 8.4 in Sydney and 7.2 in Melbourne (according to CoreLogic's calculations using data from the Australian National University), compared with 5.7 in Brisbane. Before the current growth phase, affordability ratios were much lower; Sydney and Melbourne both had ratios of 6.7.

See also:

Median property prices highlight affordability pressures