A tale of two cities

Contact

A tale of two cities

LJ Hooker has just released its latest White Paper looking at supply and demand in the Sydney and Perth real estate markets.

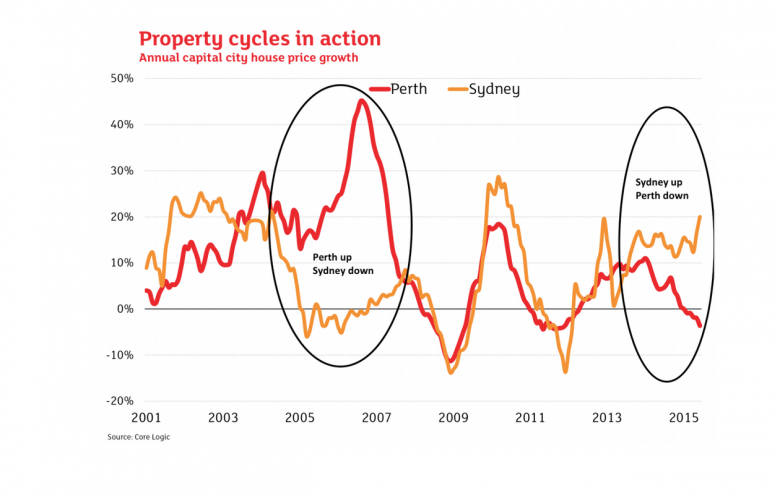

If you needed further proof that supply and demand are the greatest drivers of the property cycle, look no further than Sydney and Perth’s current positions, says LJ Hooker. These two cities highlight just how important it is to take a long-term view of real estate investment, the firm says in their latest White Paper. Sydney is currently booming while Perth's property market is in decline, but both cities experienced market ebbs and flows over the past 10 years, says LJ Hooker’s National Research Manager Mathew Tiller. Sydney’s property market contracted between 2004 and 2008 as a result of rising unemployment and flat population growth, and there were simply too many homes on offer than were needed at the time. “Today’s buyers might think it unbelievable that prices could go backward, but that was the reality in Sydney from 2004-2008, when the median dropped from $498,000 to $493,000," says Tiller. At the same time in Perth, the property cycle was unable to keep up with the additional 250,000 residents brought over by the mining boom, and median property prices almost doubled from $230,000 to $445,000 and by as much as 30% per annum in regions such as the North West. "Fast forward to today and it’s a tale of two cities," says Tiller, "with Sydney’s supply unable to meet demand created by record-low interest rates and lower unemployment; while mining investment in WA has slowed and population growth declined." The report states that savvy buyers and sellers, however, will see opportunities in all phases of the property cycle, and in some instances counter-cyclical transactions can yield the highest results. "However, in most instances, real estate should be viewed and purchased as a long-term investment. This is because despite market cycles moving up and down the overall long-term trend, for capital city markets, is generally upwards."