Sydney, Melbourne and Brisbane in top 20 for global prime residential price growth

Contact

Sydney, Melbourne and Brisbane in top 20 for global prime residential price growth

Malcolm Gunning, President of the REIA discusses Knight Frank's Prime Global Cities Index, with three Australian cities making the top 20 for global prime residential price growth.

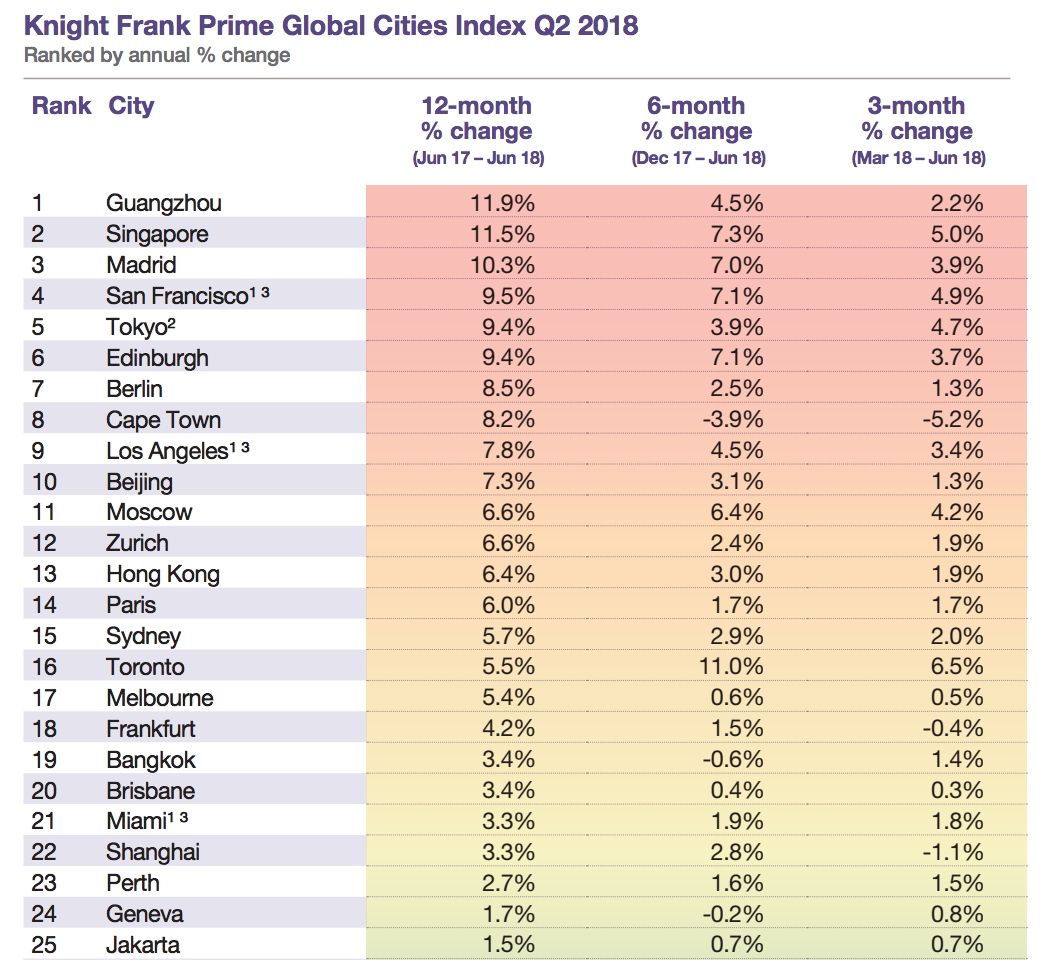

Knight Frank has launched their Prime Global Cities Index Q2 2018 with three Australian cities making the top 20 for global prime residential price growth this quarter.

Sydney, Melbourne & Brisbane have made the list at 15th (5.7 per cent), 17th (5.4 per cent) and 20th place (3.4 per cent prime price growth) respectively.

Prime property is defined as the top five per cent of the housing market; essentially the most desirable and most expensive property in each city.

Knight Frank Prime Global Cities Index Q2 2018

Malcolm Gunning, President of the REIA told WILLIAMS MEDIA that the global cities index has a range of criteria including liveability and security.

“I thought Australia would have ranked higher, particularly Sydney and Melbourne.

“It’s probably to do with our economy and growth, and Melbourne and Sydney are likely to have failed on affordability.”

“As far as liveability is concerned our cities would rank highly but that has to be tempered with economy.”

Related reading: Seven global hotspots for real estate investment

Perth also came in at 23rd on the global list with 2.7 per cent prime price growth.

Mr Gunning said this shows that Perth is recovering and transitioning from a mining boom into a more sustainable growth curve.

“This doesn’t surprise me. It’s the same for Brisbane which is also coming out of a mining boom.

“It is recognising the attractiveness of both Perth and Brisbane to live in, they are very desirable places now that there is more employment.”

He said Brisbane and Perth will rise up the scale as the economy and job opportunities grow, and liveability gets better.

“What will happen is they will get closer to the index of both Sydney and Melbourne who in the future will be hampered as they are quiet large cities.

“Both Sydney and Melbourne will be densely populated, strong economies, but not necessarily offer the same lifestyle and affordability.

“Sydney and Melbourne were at one stage in the top half dozen, but they have come back down due to population growth and affordability in the last three to five years.”

Guangzhou in China (11.9 per cent prime growth) leads the annual rankings, down from 16.1 per cent last quarter.

Related reading: Sydney, Melbourne, Hobart climb Knight Frank global price-growth index

“Guangzhou is a very strong area economically.”

“It’s where all the manufacturing came out of the China boom. Under that they built a great city.”

According to Knight Frank’s The Wealth Report, globally, the number of ultra-wealthy people (those with net assets of US$50 million or more) rose by 10 per cent in 2017 – taking the global population to 129,730, with a combined worth of US$26.4 trillion.

In Australia, the number of ultra-wealthy people rose by 9 per cent in 2017 – taking the population to 1,260, with a combined worth of US$269 billion. This is equivalent to 5.2 ultra-wealthy individuals per 100,000 of the Australian population.

Knight Frank’s head of residential, Australia Sarah Harding said, “Prime properties are dependent on increasing wealth flows, taking away the reliance the mainstream market has on income growth”.

“Over the next five years, Australia’s ultra-wealthy population is projected to increase by 37 per cent.

“We are seeing more of our prestige buyers seeking their second and third homes, not for income-producing purposes.

“This has resulted in these buyers not releasing a property to market before buying another, limiting the number of prime opportunities.”

Click here to read the Knight Frank Prime Global Cities Index Q2 2018

Related reading:

Market rationalisation underway, says REIA

Collective sales up 600% in last five years, says Knight Frank